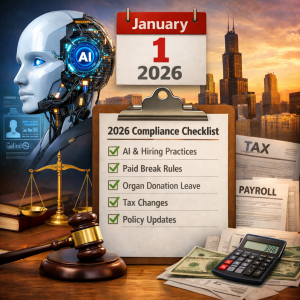

For Chicago-area business owners, January 1, 2026 is shaping up to be a deceptively important date. There is no single headline-grabbing law taking effect. Instead, several Illinois and federal changes arrive at once, quietly affecting hiring practices, payroll, employee benefits, business expenses, and tax planning. These are exactly the kinds of changes that tend to create problems when they are discovered too late.

For Chicago-area business owners, January 1, 2026 is shaping up to be a deceptively important date. There is no single headline-grabbing law taking effect. Instead, several Illinois and federal changes arrive at once, quietly affecting hiring practices, payroll, employee benefits, business expenses, and tax planning. These are exactly the kinds of changes that tend to create problems when they are discovered too late.

One of the most significant developments involves the use of artificial intelligence in employment decisions. Beginning January 1, 2026, Illinois law treats misuse of AI in employment as a potential civil rights violation. Employers using AI tools for recruiting, resume screening, interview scoring, scheduling, performance evaluations, or similar decisions must ensure those tools do not produce discriminatory results. The focus is on outcomes, not intent. Even well-meaning employers can face exposure if automated systems disproportionately affect protected classes. The law also requires notice to employees when AI is used in covered employment decisions, making it important to understand how HR software actually functions.

Another change affects payroll practices for nursing mothers. Illinois now requires that

Chicago Business Attorney Blog

Chicago Business Attorney Blog